|

Sequestration and the IDEA

Q. What is sequestration? (Pronounced se″kwes-tra´shun)

A. Sequestration is a fiscal policy procedure adopted by Congress to deal with the federal budget deficit. It first appeared in the Gramm-Rudman-Hollings Deficit Reduction Act of 1985.

Simply put, sequestration is the cancellation of budgetary resources -- an "automatic" form of spending cutback. (Learn more here.)

Q. Why is sequestration important now? A. The Budget Control Act of 2011 (BCA) established a 12 member Joint Select Committee on Deficit Reduction (or “super committee”) charged with reducing the deficit by an additional $1.2 - $1.5 trillion over ten years. The BCA also included a sequestration hammer should the super committee fail, a provision intended to “force” the super committee to act. Despite the threat of sequestration, the super committee failed. Announcing its inability to reach an agreement on November 21, 2011, the members of the bipartisan committee stated that "after months of hard work and intense deliberations, we have come to the conclusion today that it will not be possible to make any bipartisan agreement available to the public before the committee's deadline." So, as established in the BCA, sequestration was triggered when the super committee failed to reach an agreement. Sequestration generates automatic cuts for each of nine years, FY 13-21, totaling $1.2 trillion. Sequestration was originally scheduled to take effect on Jan. 2, 2013. However, it was delayed for two months - until March 1, 2013, by the deal struck on New Year's Eve, called the American Taxpayer Relief Act of 2012.

Now, without Congressional action to prevent sequestration, the first round of cuts will take place on March 1, 2013. The 2013 cuts apply to “discretionary” spending and are divided between reductions to defense ($500 billion) and non-defense ($700 billion). Q. What must occur in order to avoid sequestration?

A. Sequestration can only be avoided if Congress passes legislation that undoes the legal requirement in the BCA and that President Obama will sign before March 1, 2013.

While advocacy efforts to prevent sequestration are beginning to spring up, the strongest efforts focus on preventing the deep cuts to defense spending.

Q. Can the Executive Branch reconfigure sequestration cuts?

A. No. The cuts are automatic, across-the-board reductions to all discretionary programs unless exempted by the BCA. (A list of exempt programs is available here.) The Executive Branch will have no authority or ability to redistribute the cuts.

Q. What impact will sequestration have on federal education programs and specifically, for funds provided to states and local school districts to support special education services?

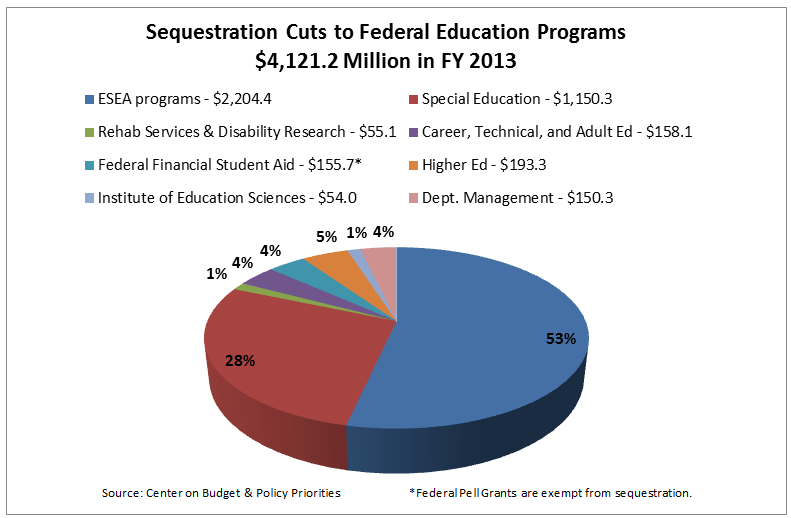

A. Under sequestration, education funding will be subject to cuts ranging from 9.1% (in 2013) to 5.5% (in 2021) according to the Center on Budget & Policy Priorities. The reduction in FY 2013 would by $4.1 billion. These cuts would be distributed across the various education programs based on current funding levels. The Education Department cuts in FY 2013 will be distributed as shown in the following chart.

Under sequestration, federal funding for the Individuals with Disabilities Education Act will be reduced by $1,053,600,000 in 2013, or 28 percent of the total reduction to education programs.

Q. What could be the result at the school and school district level if IDEA federal funds are reduced by such a significant amount?

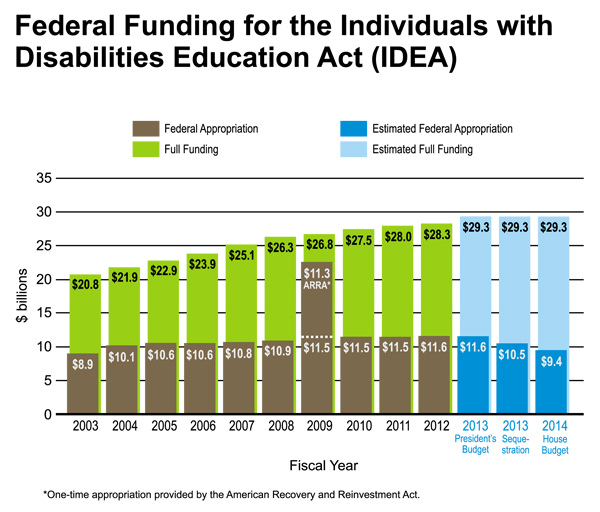

A. A $1.1 billion reduction in IDEA federal funds in 2013 will put the federal contribution toward the cost of special education back to its 2005 level. Equally important, federal funds for IDEA have never come close to the amount authorized by IDEA, often referred to as “Full Funding.” The chart below details IDEA federal funding over the past decade, along with the impact of both sequestration and the House Budget Plan.

This sharp decline in IDEA federal funding will force school districts to either reduce services beyond what is needed to provide a free appropriate public education to students with disabilities or supplement the shortfall with local funds—something unlikely to happen given continuing effects of the recession and the “lag time” between economic recovery in general and the effects, particularly in revenue, felt by state and local governments. Close to 15,000 special education teachers could lose their jobs under sequestration. The result would mean higher student-teacher ratios (aka class size), as well as fewer support personnel such as aides who provide valuable and necessary assistance to skilled special educators. Visit our state-by-state Sequestration Calculator to learn how much funding will be lost by your state.

|